maryland digital advertising tax sourcing

Battle against Maryland digital advertising tax continues as first payments come due North America Mar 14 2022. 3 The new normal will be an accelerated arrival of trends that were forming pre-pandemic.

Maryland Enacts Digital Ad Gross Revenues Tax Grant Thornton

The statutory references contained in this publication are not effective until March 14 2021.

. Colorado delays sales tax sourcing requirement for small businesses North America Feb 02 2022. Offer period March 1 25 2018 at participating offices only. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

28 that address major aspects of the foreign tax credit regimeincluding tightening the rules governing the creditability of foreign taxes and potentially further restricting creditability of foreign taxes relative to the previous regulationsThe final regulations finalize some but not all of the provisions previously. Kentucky Governor Beshear signed HB 474 into law on April 8 2022 and Maryland. Employment Labour Laws and Regulations 2022.

The IRS released final regulations on Dec. We would like to show you a description here but the site wont allow us. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

Time Value of Money. We would like to show you a description here but the site wont allow us. Tax-Basis Financial Statements and Other Special Purpose Frameworks 100.

If you have any questions about our company or one of our developments please contact us. Anthony is the Head of Hotels for the growing hospitality portfolio at ASH NYC. The digital divide between rich and non-rich.

May not be combined with other offers. Origin-sourced sales are taxed where the seller is located while destination-sourced sales are taxed at the location where the buyer takes possession of the item sold. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6.

ICLG - Employment Labour Law covers common issues in employment and labour laws and regulations terms and conditions of employment employee representation and industrial relations discrimination maternity and family leave rights and business sales in 35 jurisdictions Published. According to Avalara an automated tax compliance software solution. Streaming on-demand and cord-cutting entertainment.

Remote- and from home-working. What Every CFO Should Know About Implementing a New ERP - Video. List of jurisdictions for International Comparative Legal Guides - providing current and practical comparative legal information in a QA and comparable format.

On April 25 the Washington Court of Appeals held that a company that arranges and manages displays for installation and placement in multiple retail brands stores through subcontractors was subject to the states retailing business and occupation tax the BO tax and retail sales tax as a retailer making retail sales rather than a provider of services and other activities. Two states enacted insurance data security legislation based on the NAIC Insurance Data Security Model Law MDL-668. To qualify tax return must be paid for and filed during this period.

In this role Anthony oversees operational programming for hotel assets from the conceptual stages and through financing design development opening and stabilization in collaboration with the other members of the executive team for strategic decision-making and alignment of projects. You can start by understanding sourcing or the location where a sale is taxed. The failure of retail real estate in first-ring suburbs.

As a seller it is. Concepts and Applications - Video. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and government contracting professionals.

Amazon Smart Yacht Marketing 101 The Secrets To Sourcing Winning And Retaining The World S Richest Clientele Duncan Mark 9781912615506 Books

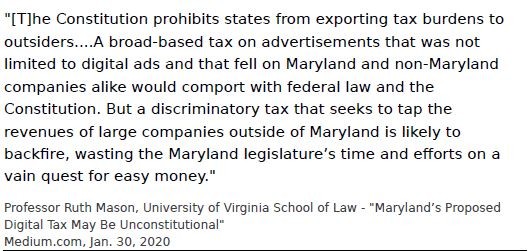

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Challenge To Maryland Digital Tax Could Save Companies Millions Bloomberg Professional Services

Challenge To Maryland Digital Tax Could Save Companies Millions Bloomberg Professional Services

The Rise Of Digital Ad Taxes Could Impact Online Marketplaces Technewsworld

The Rise Of Digital Ad Taxes Could Impact Online Marketplaces Technewsworld

Challenge To Maryland Digital Tax Could Save Companies Millions Bloomberg Professional Services

Can Anyone Be A Digital Marketer Quora

Taxnewsflash Digital Economy Kpmg United States

Amazon Smart Yacht Marketing 101 The Secrets To Sourcing Winning And Retaining The World S Richest Clientele Duncan Mark 9781912615506 Books

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

Tax Guide For 2022 Top 10 Planning Considerations Grant Thornton

The Rise Of Digital Ad Taxes Could Impact Online Marketplaces Technewsworld

We Got Nothing Maryland Comptroller Finalizes Digital Advertising Tax Regs Lexology

We Got Nothing Maryland Comptroller Finalizes Digital Advertising Tax Regs Lexology